If you ever receive a phone call, Facetime, text, letter, email, etc., please remember...MauiFed WILL NEVER ask you to provide your debit/credit card number. We will never ask for your Online Banking log in credentials or passwords. DO NOT respond to these texts or calls.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Financial Education

Whether you're planning for the future or managing your day-to-day finances, building good financial habits can provide peace-of-mind and make you feel empowered. If you would like suggestions for improving your financial health, contact us and we'll be happy to go over your current position.

Current News

Attention MauiFed Members: Stay Alert for Smishing Scams!

Smishing scams are on the rise, and it's crucial to stay vigilant to protect your personal information.

You can help protect yourself and your loved ones from smishing scams and keep your personal information secure.

HERE ARE SOME ESSENTIAL TIPS TO KEEP YOU:

-

DON'T OPEN LINKS SENT VIA SMS

If you receive a text message with a link, especially from an unknown number, do not click on it. Scammers often use these links to steal your information or install malware on your device. -

VERIFY THE SENDER

Always check the sender's phone number or email address. Scammers often disguise themselves as legitimate entities. If something feels off, contact MauiFed or your financial institution directly using a trusted phone number or email.

-

BE WARY OF URGENT MESSAGES

Scammers often create a sense of urgency to trick you into acting quickly without thinking. If you receive a message claiming that your account is at risk or needs immediate attention, take a moment to verify its authenticity.

-

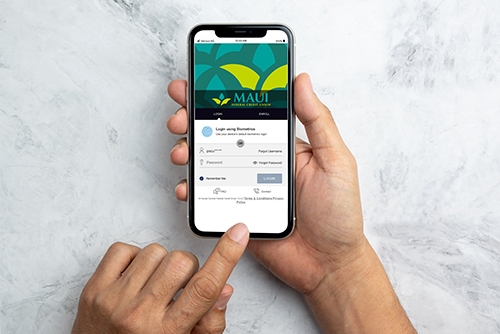

USE OFFICIAL APPS AND WEBSITES

Access MauiFed's or your financial institution's services through their official app or website instead of links sent via text messages. This ensures you're interacting with a legitimate source.

-

ENABLE TWO-FACTOR AUTHENTICATION (2FA)

Strengthen your account security by enabling 2FA. This adds an extra layer of protection by requiring a second form of verification in addition to your password.

-

KEEP YOUR SOFTWARE UPDATED

Regularly update your device's software to protect against the latest security threats. This includes your operating system, apps, and antivirus software.

By following these tips, you can help protect yourself from smishing scams and keep your personal information secure. Stay safe and vigilant!

If you think a scammer has your information, like your Social Security, credit card, or bank account number, go to IdentityTheft.gov. There you’ll see the specific steps to take based on the information that you lost.

Beware of Scams: Protect yourself from PHISHING, VISHING, & SMISHING

What is Phishing?

A phishing scam is a type of cyberattack where scammers try to trick you into giving them your personal information, like your passwords, credit card information, or bank account details. They usually do this by sending emails, text messages, or through phone calls that look and/or sound like they're from a legitimate company.

These emails, texts, and calls often claim there's a problem with your account or that you need to update your information. If it's through email or text, they'll include a link that takes you to a fake website that looks like the real website. If you enter your information on this fake website, the scammers will steal it.

Phishing works because it takes advantage of human weaknesses, such as our propensity to act curiously, trust others, or react emotionally to messages that seem urgent.

COMMON TYPES OF PHISHING:

-

EMAIL PHISHING

Email phishing is the most common type of phishing. Scammers send these emails to any email addresses they can obtain. The email usually informs you that there has been a compromise to your account and that you need to respond immediately by clicking on a provided link. -

SMISHING

Although other forms of chat- and message-based phishing attempts are frequently included in the definition, smishing attacks occur over SMS text messages. Smishing attacks take use of the lack of sender domains and branding in text messages, which would otherwise be obvious indicators of a message's fraudulent origins.

-

VISHING

Vishing scams happen over the phone or through voicemails. In the most prevalent kind, the attacker pretends to be a vendor, supplier, or partner of the target employee's business and coerces the victim into paying or disclosing private information.

-

ANGLER PHISHING OR SOCIAL MEDIA PHISHING

Angler phishing attacks take place over social media. In this scam, a fraudster sets up an account on a social media platform that resembles a well-known company, then responds to public messages left by users who are criticizing or discussing the brand in general.

If you think a scammer has your information, like your Social Security, credit card, or bank account number, go to IdentityTheft.gov. There you’ll see the specific steps to take based on the information that you lost.

Here are a few things to watch for:

-

URGENCY

Phishing emails often try to create a sense of urgency, saying that you need to act immediately or your account will be closed. It can be disguised as a known company wanting you to perform specific tasks. Unnecessary urgency is suspicious. Use your intuition and, if something "feels" wrong, call the sender's organization to validate the email. -

TYPOS AND GRAMMATICAL ERRORS

Legitimate companies usually have good grammar and spelling. If you see typos or grammatical errors in an email or text, it's a good sign that it is a scam. Another indicator is if they use a different spelling for certain words. An example would be US English and UK English. In US English "color" (no "u") is the correct spelling, while UK English uses "colour" (with a "u").

-

SUSPICIOUS LINKS

Hover over any links in emails before clicking on them. If the link looks suspicious, don't click on it. If you think you've received a phishing email, don't click on any links or attachments. You can always contact the company directly to verify the information.

- If it seems too good to be true, it probably is.

- Verify any email, text, or phone call that asks for personal information by independently looking up the sender's/caller's contact information.

It’s never too late to start saving more money. These five tips will help you trim spending, beef up savings, and reduce stress.

1. Pay it off.

Pay off your credit cards to save money. Let's say you have a $3,000 balance at 18% interest. If your minimum payment is 2% of the balance due each month (in this case $60), it will take you 7 years and 8 months to pay it off and you'll incur $2,586 in interest. But if you increase your monthly payments to 8% of the balance due (in this case $240) -- much more than the minimum--you'll reduce the payback time from 7 years and 8 months to 1 year and 4 months, and your interest costs now are only $347. You've just "saved" $2,239.

How Maui FCU Can Help

If you have high interest credit cards with balances, a personal loan or a credit card with a lower rate may be a possible option for you.

2. Transfer it.

Pay yourself first—set up automatic transfers to your share or share draft account. Have your paycheck automatically deposited to your credit union account. Consider using direct bill payment from your share draft account for recurring payments like household bills, insurance premiums, automatic investment and savings plans, mortgage payments, auto loan payments, and charitable donations. Set up a Christmas Club Account. Participate in your employer's tax-advantaged retirement plan.

3. So, what's a buck?

Grab a calculator. Add up what you spend on so-called "little things" that end up being budget-busters:

- If you spend $1.00 a day on soda, that adds up to $365 a year.

- If you spend $7.00 a day on coffee or boba, that's $2,555 a year.

- If you spend $10.00 every weekday on fast food, that's $2,610 a year.

- If you spend $30.00 every weekend on beer, that’s $1,560 a year.

- If you spend $6.20 a day on cigarettes, that's $2,263 a year.

4. Conserve.

Small changes mean big savings on your utility bill:

- Use ceiling fans to reduce both cooling and heating bills.

- Properly insulate all ducts.

- Use programmable thermostats. Turn your thermostat back 10% to 15% for 8 hours each day during the winter to save as much as 10% a year on your energy bill.

5. Tune it up.

Regular automobile maintenance—including low-cost oil changes, filter changes, and tire rotation—can save big bucks by preventing costly repairs. Keep your engine tuned and your tires inflated to their proper pressure. On the road, stay within speed limits; gas mileage decreases when you drive faster than 60 MPH. Avoid "jackrabbit" starts, unnecessary idling, remove excess weight from the trunk and combine errands.

It all adds up!

The long lazy days of summer have a way of flying by, and if you’re not careful, they can whittle down your budget just as fast. Avoid a budget burnout by watching for these budget-busters.

Day camps.

Rather than resorting to expensive day camps for the kids, check with your local library or city’s park and recreation department for free or low-cost programs available for children.

Extra driving.

Park visits, beach days, and zoo days have a way of guzzling up your gas. Consider limiting day trips to a couple times a week, or parking in a central location and walking from there.

Lack of planning.

Busy summer days can make it tempting to give meal planning a break, which can mean last-minute trips to the store, or extra eating out. Consider foods that are easy to prepare and fun to eat, including meats and vegetables to grill.

Keeping things cool.

Consider ways to reduce the length of time your air conditioner runs, such as opening windows at night, using fans, and keeping blinds closed on hot sunny days.

Restocking summer clothes.

Be sure to shop your own closet before heading out for new clothes for the new season. If you still need new clothes for the season, consider classic items that remain trendy and are more likely to remain evergreen from summer to summer.

Summer gear.

Tents, coolers, hammocks, lawn furniture—they all sound tempting for summer, but consider how much you’ll use each new item versus how necessary it is to have a new one.

Vacations.

There’s nothing wrong with a great summer vacation, but if it forces you to use credit, consider making smaller, less expensive plans and start saving up for bigger plans next summer.

Members have received Fraud Calls. If you receive any fraud calls with live representatives, please hang up and contact us or the number on the back of your debit or credit card directly. DO NOT provide any information and DO NOT click on any text or email links.

Fraudsters have found a way to mimic your financial institution’s member services, fraud hotline phone numbers, and even pose as service providers (such as utility, phone bill, cable, credit card, landscaping, etc). They can send you a fake text message or give you a ring asking to verify personal and account information in an attempt to access your funds. If you provide any personal information, they can gain access to your account.

What to do if you receive a call or text?

If you EVER receive a call and say they are your bank or service provider, DO NOT provide any account number or personal information on an INCOMING CALL.

Tell them you need to call them back. Make sure you DO NOT call the number they provide you or from your phone call history. When in doubt, call your financial institution or service provider directly.

ALWAYS PROTECT YOUR INFORMATION!

It is critical to remain vigilant and protect yourself from financial fraud. Technology is advancing at an incredible rate, as are fraud techniques and the necessary countermeasures.

It's all too tempting to dismiss financial fraud as something that only happens to other people. Even if you're a knowledgeable shopper, it's all too simple to fall prey to illicit activities. Financial fraud, unfortunately, can take various forms and has a wide range of negative implications.

Follow these tips:

- Invest in a Paper Shredder

Account holders at many banks and financial institutions can sign up for paperless statements. Even if you go that route, you may still receive documents containing sensitive financial information in the mail. If you simply throw those documents away, a criminal could obtain them and use them to commit fraud.

That is why a paper shredder is an excellent investment. For around $50, you can purchase a machine that will render your sensitive documents unreadable to even the most determined thief. - Check your credit report on a regular basis

A criminal who obtains your Social Security number may use it to open a credit card or line of credit in your name. However, if you check your credit report on a regular basis, you may be able to detect fraudulent activity and stop it sooner rather than later.

Normally, you are entitled to a free copy of your credit report from each of the three credit reporting bureaus – Experian, Equifax, and TransUnion – once a year. - Know How to Identify Phone, Email, and Text Message Scams

Those annoying spam calls you get on your phone from time to time? They are frequently criminals looking for information.

It is critical that you do not respond to unsolicited emails, texts, or phone calls requesting confirmation of your bank account information or Social Security number. If you do, you may end up making a criminal's life much easier – and yours much more difficult. When in doubt, contact your financial institution. - Protect Your Online Identity

The pandemic has forced many to work from home and rely on the digital world, the need to protect online identity has also increased. Protect yourself from entering your information on unsecured websites and forms. - Protect Your Phone Number

Hackers, identity thieves, and scammers can use your phone number to find out where you are (or will be), impersonate you, hijack your phone, or access your accounts.

- Don’t give out your phone number online. Unless you trust a person, don’t give them your number, even if you bought something from them. If you must share it, do it privately (via email or a direct message) and not on a public message board.

- Get a phone number with Google Voice. It’s free and the number is not connected to your entire life.

- Use a strong password for connected services. You can use an online service like Have I Been Pwned to check if you’ve already been compromised.

Prevent fraud by safeguarding your online information, monitoring your accounts, shredding sensitive documents, and thinking twice before sharing sensitive information.

With spring cleaning season upon us, many will take the opportunity to polish up home, health and finances too. Just as you likely have different methods for cleaning up different parts of your home, the different aspects of your finances require various degrees of attention, care, and scrubbing. Consider these financial not-to-do’s in order to clean up and polish just right.

Financial Not-to-Do’s

- Going too extreme – When it comes to cleaning up your finances, your budget can be a good place to start. Just be careful not to give it an overhaul that’s so extreme it becomes unsustainable.

- Closing old cards – While there are several legitimate reasons for closing out an old credit card, something to consider is the affect that action will have on your overall credit rating. Closing out an old card can affect your average length of history and credit utilization ratio, both of which could affect your credit score in a negative way.

- Splurging your tax refund – A good rule of thumb for tax returns is to avoid splurging on something you would not have otherwise purchased. Rather, consider paying down existing debt, padding your emergency fund, or building an education account.

- Misplacing your money – If you’re working on building up a special savings—whether for emergencies, vacation, education, retirement, or something else—be sure to take advantage of high-yield accounts to make the most of your savings. If you’re not sure about your options, contact an Maui FCU member service representative to learn about our savings accounts that are designed to help you earn more.

During the holidays it’s important be on guard and protect yourself from scammers. As much as we look forward to the holidays, scammers enjoy this time of year even more. After all, it’s natural to let your security slip a little when you’re busy and spending a lot.

Keep an eye out for these popular scams:

- Holiday Vacation Scams – Flights around the US and other countries are tempting especially for a great, low price, but be wary of too-good-to-be-true offers. Make sure to book through reputable websites.

- Fake Charities – Phone calls and flyers from organizations with familiar-sounding names may ask you for donations. To be safe, don’t give to any charity with whom you didn’t start the contact.

- Fake Public Wi-Fi – Think before you connect to public Wi-Fi. If you do choose to use public Wi-Fi, remember that you shouldn’t have to install anything and don’t use unsecured connection to access bank accounts or other sensitive info.

- Vehicle Rental Scam – Renting a vehicle- car or motorcycles, can be a great way to explore every nook and cranny of a city. Watch out here as when you return the vehicle, the owner might demand additional payments to repair damages that were already there, but you failed to notice.

Prevent fraud by guarding your online information, monitor your accounts, shred sensitive documents, and always think twice about sharing your information.

Scammers are using the pandemic to benefit themselves by stealing personal information from their victims. Using telemarketing calls, text messages, social media platforms, and even door-to-door visits to perpetrate COVID-19-scams, these scammers offer anything from COVID-19 testing and U.S. Department of Health and Human Services (HHS) grants to Medicare prescription cards in exchange for personal details, which can then be used to fraudulently bill federal health care programs and commit medical identity theft.

Protect yourself from scammers:

- Vaccines – You will not be asked for money to enhance your eligibility to receive a vaccine; you will not be contacted by Government or State officials regarding the vaccine; and you will not be solicited door to door to receive the vaccine.

- COVID-19 related products and services – Since Medicare will not contact beneficiaries to offer COVID-19 related products and services, always be cautious of unsolicited requests for personal, medical, and financial information.

- Text messages – Do not open hyperlinks received by unknown individuals, and never respond to text messages regarding COVID-19.

- COVID-19 testing – Before making an appointment for a COVID-19 test online, make sure the location is listed as an official testing site.

- HHS grant – Do not give your personal or financial information to anyone claiming to offer HHS grants related to COVID-19.

-

Contact tracers – Legitimate contact tracers will never ask for your Medicare number, financial information, or attempt to collect money from you for a COVID-19 test or for any other reason.

Maui FCU will be counting down the holidays with tips to revamp your Holiday Shopping Habits. It’s easy to get wrapped up in giving the perfect gift to everyone you know during the holiday season. But there is such a thing as being too generous, especially when it becomes a hazard to your finances. Consider these holiday spending tips to get you through the holiday season without crumbling your budget.

Tip #1 to Revamp Your Holiday Shopping Habits

Make a list. Write down everyone you plan to give gifts to. Set a price limit for each person to keep your budget on track!

Tip #2 to Revamp Your Holiday Shopping Habits

Price check. If you’re doing your shopping in-store, use your phone to see if you can find a better price somewhere else. Many stores will do a price-match if you can show them a better price is available at another retailer.

Tip #3 to Revamp Your Holiday Shopping Habits

Get Rewarded. If you’re going to use a credit card for your holiday shopping, you may as well get something in return for doing so. If you’re not already using a credit card that features rewards, consider applying for a Maui FCU credit card to start earning reward points for all your holiday shopping.

Tip #4 to Revamp Your Holiday Shopping Habits

Don't Procrastinate. You're more likely to overspend when you're shopping in a rush, so don't wait until the last minute to hit the stores. Plan ahead and take your time to watch for good sales.

Tip #5 to Revamp Your Holiday Shopping Habits

Stay on Top of Your Spending. Pay your bills regularly and use online banking and account statements to keep track of your spending.

- Setup your online banking. Banking online means accessing your bank account and carrying out financial transactions through the internet on your smart device or computer. This gives you the ability to manage your bank account when it's most convenient for you.

- Download the Maui FCU Mobile Banking App. The advantages of mobile banking include: Ease of Access, Allows you to track your finances, and it's convenient & secure.

- Control Your Spending using our built in Debit Card Management service located conveniently in your Maui FCU Mobile App. If you're trying to establish or stick to a budget, our Debit Card Management can help! Set spending limits for general use of specify thresholds by merchant types like gas, groceries, or retail stores.

Tip #6 to Revamp Your Holiday Shopping Habits

Avoid Shopping Sprees. Create a list of gift ideas and then stick to it when you enter a store. If you feel tempted to make off-list purchases, consider leaving the store for a few minutes to give yourself time to think about your purchases before making them.

Tip #7 to Revamp Your Holiday Shopping Habits

Consider Making Gifts. A homemade gift may not work for everyone on your list, but a thoughtful gift - whether photos for grandparents or baked goods for teachers and neighbors - are good options for many.

Tip #8 to Revamp Your Holiday Shopping Habits

After Holiday Planning. Now that you've survived the holidays, preparing for next year's season is probably the last thing you want to do. But trust us on this - taking the time now to plan and save for the next holiday season is the best way to ensure more joy and less stress next time.

Check Back to for More Financial Tips! Make sure to check back for new financial tips that will help improve your finances and make managing your finances a breeze.

The Perfect Blend for Healthy Finances

Offering you the ingredients you need to set up health finances – Savings and Checking solutions at your fingertips.

Explore our Digital Tools

Mobile App Suite

Get the Details and Alerts

Access Your Accounts, Pay Bills and More – All from Your Mobile Device.

Mobile Deposit

Here’s How

Tap, Snap, and Deposit your Checks.

eStatements

See Yours

Go Green and Skip the Printed Statement.

Alerts

Always Know

Personalize Your Alerts and Get Them on Your Phone.